2025

CA Património Crescente Fund was honoured by APFIPP (Portuguese Association of Investment, Pension and Asset Funds) as the best Open Fund (5th time).

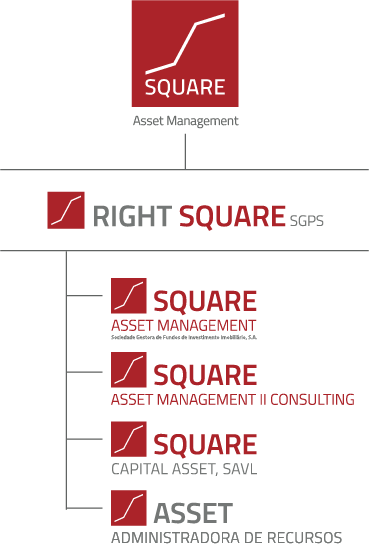

19 YEARS in the market, 13,1% OF MARKET SHARE, 2,4 BN EUROS* under management, SQUARE A.M. is the 1ST INDEPENDENT COMPANY of Real Estate Investment Funds in Portugal. It’s

also responsible for managing 2 award-winning funds.

CAPC was 14 TIMES WINNER of the MSCI award and awarded by APFIPP (Portuguese Association of Investment Funds, Pensions and Assets) as the Best Accumulation Open-ended Real Estate Investment Fund for the 5th time.

In 2024, the Saudeinveste Fund is proud to join the list of awarded Funds and was also a winner by APFIPP, for the Best Rental Close-ended Real Estate Investment Fund.

In 2020, 2022 and 2024, Square Asset Management was also awarded as “Best Investment Manager” by Euromoney.

(*) AUM managed by SQUARE ASSET MANAGEMENT, SOCIEDADE GESTORA DE ORGANISMOS DE INVESTIMENTO COLETIVO, S.A. & SQUARE ASSET MANAGEMENT II CONSULTING

(April 30th, 2025)

CA Património Crescente Fund was honoured by APFIPP (Portuguese Association of Investment, Pension and Asset Funds) as the best Open Fund (5th time).

CA Património Crescente wins MSCI award for the 14th time for best performance national portfolio, for a 3 year period.

CA Património Crescente Fund was awarded by APFIPP as the Best Accumulation Open-ended Real Estate Investment Fund.

The Saudeinveste Fund was awarded by APFIPP as the Best Rental Close-ended Real Estate Investment Fund.

19 Years of activity and success of CA Património Crescente Fund.

Property Core Real Estate Fund reaches 100M€ AUM.

Square Asset Management was awarded “Best Investment Manager” for the 3rd time by Euromoney.

Launch of ALEGRO MONTIJO SIC IMOBILIÁRIA FECHADA, S.A.

Launch of BRAFERO SIC IMOBILIÁRIA FECHADA, S.A.

CA Património Crescente Fund wins MSCI award for the 13th time for best performance national portfolio, for a 3 year period.

Property Core Real Estate Fund reaches 50M€ AUM.

Launch of PDSM PORTFOLIO (PORTUGAL) – SIC IMOBILIÁRIA FECHADA, S.A.

Launch of FORUM COIMBRA SIC IMOBILIÁRIA FECHADA, S.A.

A Património Crescente wins MSCI award for the 12th time for best performance national portfolio, for a 3 year period.

Euromoney awarded Square Asset Management as “Best Investment Manager” for the 2nd time.

CA Património Crescente Fund reaches 1Bi euros of net assets (april).

A Património Crescente wins MSCI award for the 11th time for best performance national portfolio, for a 3 year period.

16 Years of activity and success of CA Património Crescente Fund.

1,3 Billion euros of assets under management in December 31, 2021 (Square A.M. & Square Consulting).

Launch of PC Core Real Estate Fund

(Open-Ended Income Fund).

Euromoney awarded Square Asset Management as “Best Investment Manager”.

CA Património Crescente wins MSCI award for the 10th time for best performance national portfolio, for a 3 year period.

15 Years of activity and success of CA Património Crescente Fund.

1,5 Billion euros of assets under management in december (Square A.M. & Square Consulting).

CA Património Crescente wins MSCI award for the 9th time for best performance national portfolio, for a 3 year period.

1,4 Billion euros of assets under management in december (Square A.M. & Square Consulting).

CA Património Crescente wins MSCI award for the 8th time for best performance national portfolio, for a 3 year period.

APFIPP and Jornal de Negócios awards CAPC best open ended Real Estate Investment Fundaward for the 3rd year in a row.

1.032 million Euros of assets under management (December).

CA Património Crescente wins MSCI award for the 7th time for best performance national portfolio, for a 3 year period.

APFIPP and Jornal de Negócios awards CAPC best open ended Real Estate Investment Fund award for the 2nd year in a row.

945 million euros of assets under management.

CA Património Crescente wins the MSCI award for the 6th time for the Best Performance Iberian Portfolio for a 3 year period.

The CA Património Crescente Fund was distinguished as the Best Open-Ended Investment Fund by the Portuguese Association of Investment, Pension and Asset Funds (APFIPP) in partnership with Jornal de Negócios.

CA Património Crescente wins the MSCI award for the 5th time for the Best Performance Iberian Portfolio for a 3 year period.

CA Património Crescente wins the MSCI award for Best Iberian Portfolio Performance for a 3 year period, for the 4th time in a row (Portuguese and Spanish Portfolios were considered separately).

800 million euros of assets under management (June).

CA Património Crescente wins the MSCI award for the Best Iberian Portfolio Performance for a 3 year period, for the 3rd year in a row.

Launch of Carteira Imobiliária (Asset Restructuring Fund).

CA Património Crescente wins the MSCI award for the Iberian portfolio with the best performance for a three year period, for the 2nd year in a row.

700 million euros of assets under management (April).

CA Património Crescente wins the MSCI award for Best Iberian Portfolio Performance, for a 3 years period, for the 1st time.

400 million euros of assets under management (June).

500 million euros of assets under management (November).

Launch of CA FIAH (Housing Lease Fund)

300 million euros of assets under management (October).

100 million euros of assets under management (June).

200 million euros of assets under management (December).

Launch of CA Património Crescente (Open Income Fund).

Launch of CA Imobiliário (Asset Restructuring Fund).

Provision of services to Grupo Crédito Agrícola kick off: creating its first real estate investment fund.

SQUARE A.M. becomes the 1st Independent Company to be contracted by a large financial group in Portugal to market and manage open-ended investment Funds.

Establishment of SQUARE A.M. as an independent regulated

management company with 4 partners.