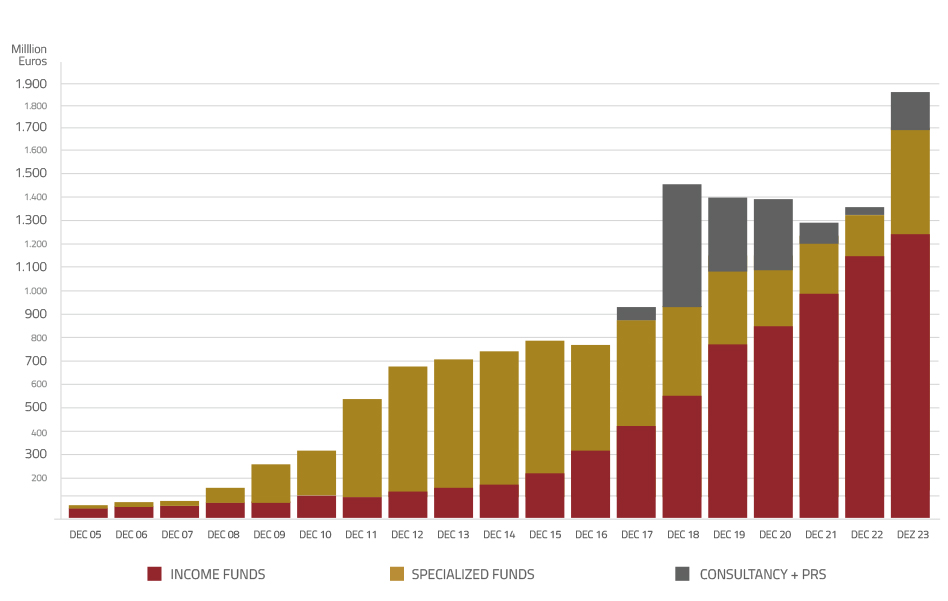

SQUARE is one of the largest Real Estate Asset Management and Consulting Group in Portugal. Our 18 successful years let us proudly state that we are the only independent management company managing Open-ended Real Estate Investment Funds and the 1st contracted by large Portuguese financial groups. Our experience granted us 13% of market share and 1,9 Billion euros of assets under management*. SQUARE A.M. specializes in 3 different areas: Income Funds, Specialized Funds and other vehicles like Strategic Consultancy. Always looking for the best results through consistency and Innovation to earn our Clients' Trust.

(*) AUM managed by SQUARE ASSET MANAGEMENT, SOCIEDADE GESTORA DE ORGANISMOS DE INVESTIMENTO COLETIVO, S.A. & SQUARE ASSET MANAGEMENT II CONSULTING

(February 29th 2024)

(*) AUM managed by SQUARE ASSET MANAGEMENT, SOCIEDADE GESTORA DE ORGANISMOS DE INVESTIMENTO COLETIVO, S.A. and SQUARE ASSET MANAGEMENT II CONSULTING

(*) AUM managed by SQUARE ASSET MANAGEMENT, SOCIEDADE GESTORA DE ORGANISMOS DE INVESTIMENTO COLETIVO, S.A. and SQUARE ASSET MANAGEMENT II CONSULTING